Six Sigma ROI: Measuring What Matters to Your Bottom Line

Organizations implementing Six Sigma see an average return of $230,000 per project and 4.5-6x ROI on their training investment.

Yet many companies struggle to accurately measure these returns, leaving value on the table and making it harder to justify future improvement initiatives.

Stop Leaving Money On The Table

Learn how to maximize your process improvement returns.

Understanding how to calculate, track, and maximize Six Sigma ROI isn’t just about numbers—it’s about speaking the language that resonates with executives and stakeholders who approve your budgets.

Whether you’re launching your first project or managing an established program, mastering ROI measurement transforms Six Sigma from a cost center to a profit driver.

When implemented correctly, Lean Six Sigma consultation initiatives deliver remarkable financial results. Organizations often discover that the roi of lean six sigma extends beyond direct cost savings into areas like customer retention, market share growth, and operational excellence.

Key Highlights

- Proven calculation methods for accurate returns

- Tangible vs. intangible benefit tracking

- Project selection for maximum ROI

- Long-term measurement strategies

What Are Six Sigma ROI Fundamentals

Organizations invest substantial resources in improvement initiatives, making it crucial to quantify the returns these efforts generate.

Six sigma ROI provides the financial justification that keeps programs funded and teams motivated to deliver results.

Without clear ROI metrics, even the most technically sound projects risk losing support from key decision-makers.

What Is ROI In Six Sigma?

Return on Investment in Six Sigma represents the financial value created by improvement projects relative to their implementation costs. The basic formula calculates this as:

Six Sigma ROI = (Financial Benefits – Project Costs) / Project Costs × 100%

For example, a project costing $50,000 that delivers $200,000 in savings yields a 300% ROI. This straightforward metric helps translate technical improvements into financial language that executives understand and appreciate.

The roi in six sigma extends beyond simple cost-benefit analysis. It connects process excellence to strategic business goals like market share growth, customer retention, and competitive advantage.

When properly measured, Six Sigma ROI demonstrates how operational improvements directly support organizational priorities and financial targets.

Many organizations establish minimum ROI thresholds (typically 3:1 or higher) for project approval, ensuring resources flow to initiatives with the greatest potential impact.

This disciplined approach to project selection differentiates mature Six Sigma programs from those that chase improvements without clear financial returns.

Teams looking to build this financial discipline often benefit from understanding the fundamentals of Lean that underpin effective improvement work.

Types Of Returns In Six Sigma Projects

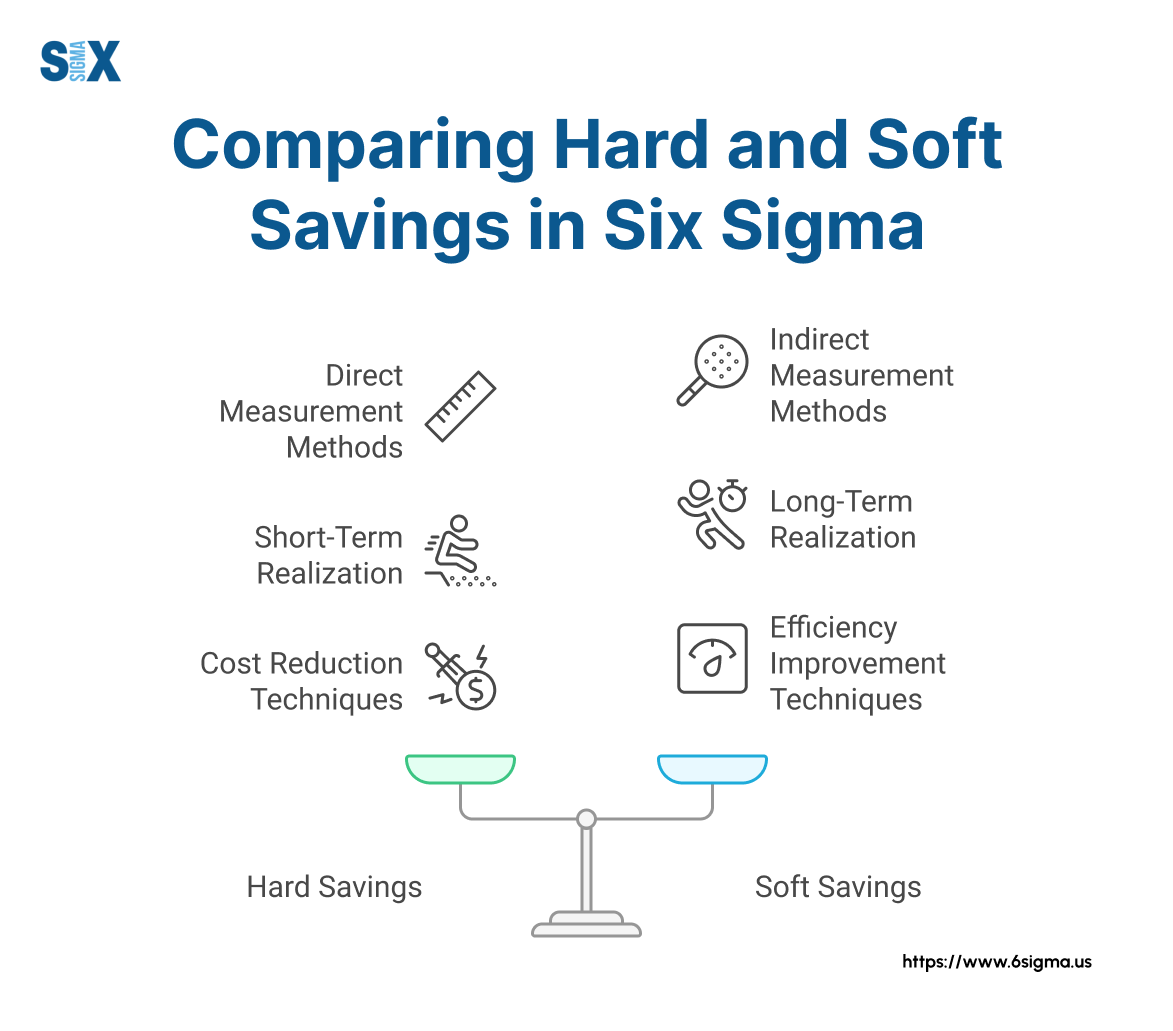

Six Sigma projects generate two distinct categories of returns, each requiring different measurement approaches:

Hard (tangible) savings represent directly measurable financial benefits that appear on financial statements.

These include:

- Reduced material waste

- Lower labor costs through improved efficiency

- Decreased warranty claims and returns

- Reduced inventory carrying costs

- Lower energy consumption

Soft (intangible) benefits deliver real value but prove more challenging to quantify in exact dollar terms.

Examples include:

- Improved employee satisfaction and retention

- Enhanced customer loyalty

- Stronger brand reputation

- Better regulatory compliance

- Increased organizational agility

Turn process excellence into profit. Get a clear roadmap for measurable results.

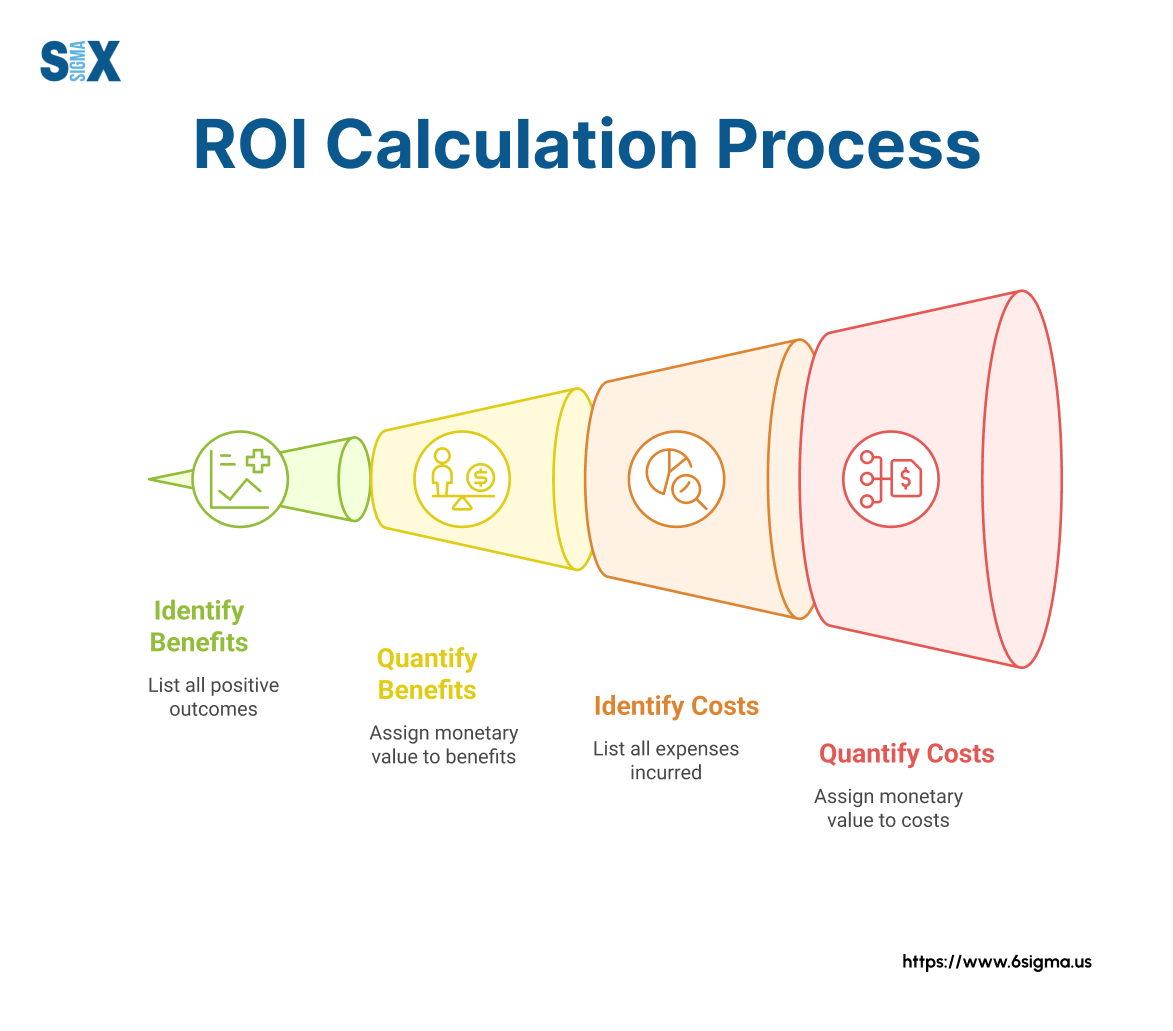

Calculating Six Sigma ROI: A Practical Approach

Measuring the financial impact of process improvement efforts requires both rigor and pragmatism.

Organizations that excel at Six Sigma ROI calculations typically outperform competitors by making smarter investment decisions and building stronger cases for continued improvement work.

The ability to translate operational gains into financial terms often separates successful continuous improvement programs from those that struggle to maintain momentum and executive support.

Basic ROI Formula And Applications

The foundation of six sigma roi calculation starts with a straightforward formula:

ROI (%) = [(Financial Benefits – Project Costs) / Project Costs] × 100

Financial benefits include both cost reductions and revenue increases attributable to the project. Project costs encompass team time, training, consulting fees, technology investments, and implementation expenses.

For example, a manufacturing defect reduction project might calculate:

- Financial Benefits: $350,000 (reduced scrap, rework, and warranty claims)

- Project Costs: $75,000 (team time, training, equipment modifications)

- ROI: [(350,000 – 75,000) / 75,000] × 100 = 367%

Different industries apply this formula with specific nuances. Healthcare organizations often factor in reduced length of stay and improved reimbursement rates.

Financial services firms might emphasize error reduction and improved transaction processing times. Manufacturing companies typically focus on yield improvements and material savings.

The most effective teams validate their calculations with finance departments before and after projects, ensuring credibility with key stakeholders.

Many professionals pursue a Six Sigma certification to master these financial validation techniques alongside technical improvement methods.

Advanced Measurement Techniques

Beyond basic calculations, sophisticated organizations employ additional methods for calculating roi for process improvement initiatives:

Net Present Value (NPV) accounts for the time value of money, particularly valuable for projects with benefits realized over multiple years. This approach discounts future cash flows to present value, providing a more accurate picture of long-term returns.

Benefit-Cost Ratio (BCR) divides the present value of benefits by the present value of costs. Projects with BCR greater than 1.0 create positive value, with higher ratios indicating more attractive investments.

Internal Rate of Return (IRR) identifies the discount rate at which a project’s NPV equals zero, useful for comparing projects with different timeframes and investment requirements.

Project-specific metrics often provide deeper insights than generic calculations.

For example:

- Customer service improvements might track cost per contact alongside satisfaction scores

- Supply chain projects could measure inventory turns and carrying cost reductions

- Quality initiatives often focus on defect rates and associated cost of poor quality

The most valuable Six Sigma ROI analyses include both immediate gains and sustained benefits. Tracking metrics for 12-24 months post-implementation reveals whether improvements stick and continue generating returns.

This long-view approach helps organizations distinguish between temporary fixes and fundamental process enhancements.

See How Much Value You’re Leaving Uncaptured

Calculate your potential returns.

Key Metrics For Six Sigma ROI Analysis

Selecting the right metrics forms the backbone of any meaningful Six Sigma ROI analysis.

Organizations that measure both financial and operational indicators gain a fuller picture of their improvement initiatives’ impact.

These metrics not only justify past investments but also help prioritize future projects for maximum returns.

The most successful Six Sigma programs establish clear measurement protocols before projects begin, ensuring objective evaluation of results.

Financial Metrics

Financial metrics translate process improvements into language that resonates with executives and stakeholders.

These hard-dollar measures provide concrete evidence of Six Sigma’s impact on organizational performance:

Direct cost savings represent the most straightforward financial benefit. These include reduced material waste, decreased labor costs through improved efficiency, and lower overhead expenses.

For example, a manufacturing company might track cost per unit produced, documenting how defect reduction directly lowers production costs.

Avoidance costs capture expenses that would have occurred without the improvement. Warranty claims, customer returns, regulatory fines, and overtime requirements often decrease following successful Six Sigma projects.

These savings, while sometimes challenging to document, represent real financial benefits.

Revenue improvements may come from increased production capacity, higher customer retention, or premium pricing opportunities due to superior quality.

A service organization might measure increased transaction volume or higher average sales resulting from improved customer experience.

Financial metrics should be validated by accounting or finance departments to ensure credibility.

Many Six Sigma certification programs include specific training on financial validation methods, equipping practitioners to work effectively with finance teams when documenting project returns.

Operational Metrics

Operational metrics capture process performance improvements that drive financial results.

These indicators often provide earlier feedback than financial measures and help teams understand the mechanisms creating value:

Process efficiency metrics include cycle time reduction, labor productivity improvement, and resource utilization.

These measures show how Six Sigma eliminates waste and streamlines operations.

For example, reducing insurance claim processing time from 10 days to 2 days represents a 80% efficiency improvement that directly impacts customer satisfaction and operational costs.

Quality improvements manifest in lower defect rates, reduced variation, and fewer customer complaints. These metrics demonstrate how Six Sigma fulfills its core promise of reducing defects to 3.4 per million opportunities.

A healthcare organization might track medication error rates, showing both patient safety improvements and cost reductions.

Capacity utilization often improves through Six Sigma projects that remove bottlenecks and optimize workflows.

Manufacturing plants might document increased throughput on existing equipment, avoiding capital expenditures while growing production capability.

The process improvement roi becomes most apparent when teams connect these operational metrics to financial outcomes. For instance, a 15% cycle time reduction that enables 15% more customer orders with the same resources translates directly to bottom-line growth.

Challenges And Solutions In ROI Measurement

Organizations frequently encounter obstacles when measuring the roi of six sigma initiatives. These challenges can undermine even well-executed projects if not properly addressed.

The most common difficulties include isolating improvement impacts from other business changes, quantifying intangible benefits, and maintaining measurement discipline over time.

Isolating the specific financial impact of Six Sigma projects becomes particularly challenging in dynamic business environments where multiple initiatives occur simultaneously.

Teams can address this by establishing clear baselines before project launch and using control groups where possible. For example, implementing a solution in one facility while maintaining current operations in another provides a natural comparison that helps isolate improvement effects.

Data quality issues frequently complicate ROI calculations. Missing or inconsistent information makes it difficult to establish reliable baselines and measure improvements accurately.

Successful organizations invest in data collection systems and validation processes before major projects begin, ensuring they can document results credibly.

Timing mismatches between improvement activities and financial results often create confusion. While operational metrics might improve immediately, financial benefits sometimes lag by weeks or months.

Creating a timeline that shows expected delays between operational improvements and financial results helps manage expectations and ensures proper attribution of benefits.

Resistance from functional leaders who fear negative financial implications can block proper ROI measurement.

The solution involves engaging these stakeholders early, addressing concerns transparently, and focusing on organizational improvement rather than individual blame.

Many organizations find that introducing Lean concepts helps build a culture where measurement is viewed as a path to improvement rather than a threat.

Future Trends In Six Sigma ROI

Digital transformation is reshaping how organizations measure and maximize Six Sigma ROI.

Real-time data collection through IoT sensors and connected equipment enables continuous monitoring of process performance without manual intervention.

This automation not only improves measurement accuracy but also allows teams to detect and address issues before they impact financial results.

Predictive analytics tools now forecast potential ROI before projects begin, helping organizations prioritize initiatives with the highest likely returns.

These models incorporate historical project data and industry benchmarks to estimate probable outcomes with increasing accuracy, reducing investment risk.

AI-powered process mining technology automatically discovers inefficiencies by analyzing system logs and transaction data.

This capability identifies improvement opportunities that might otherwise remain hidden and provides objective evidence of process changes following implementation.

Mobile dashboards deliver ROI metrics to stakeholders anywhere, increasing visibility and accountability for results.

These tools help maintain momentum by showing progress toward financial goals in real-time, rather than waiting for periodic reports.

Conclusion And Next Steps

Mastering Six Sigma ROI measurement transforms process improvement from a technical discipline into a strategic business driver.

By selecting the right metrics, addressing common measurement challenges, and leveraging emerging technologies, organizations can document the substantial returns that well-executed Six Sigma projects deliver.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs